Are you considering getting your watch (or watches) insured? Should you? Today, we’re talking about watch insurance to give you some insight.

So, you’ve done it. You finally got your grail watch. Perhaps you went the extra careful route and patiently sat on your authorized dealer’s waitlist.

Because of that, you have a warranty. Or maybe you went guerilla, did your homework, and found one elsewhere on the secondary market for a fraction of the market cost.

In this case, do you get watch insurance?

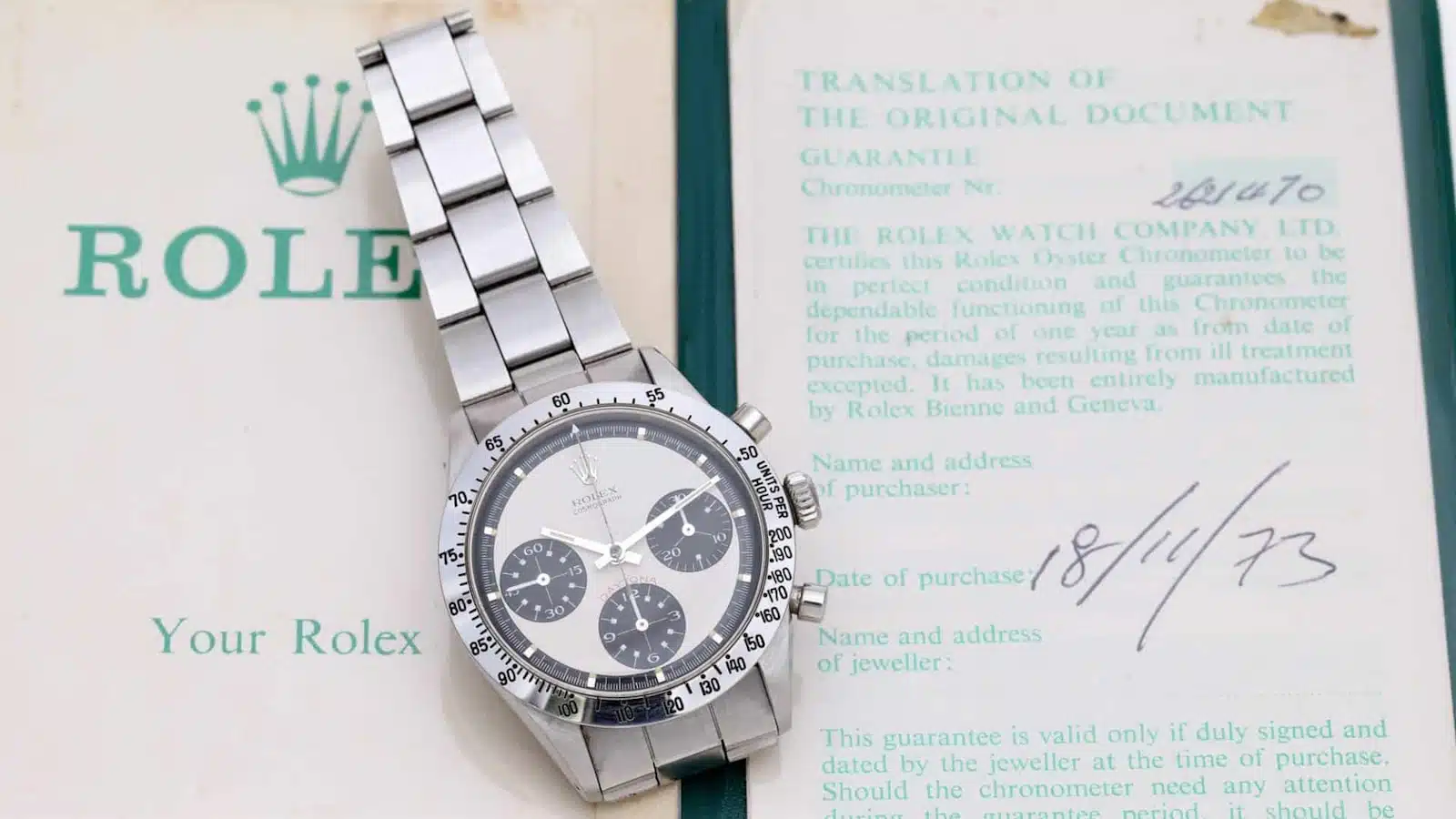

Or perhaps you just inherited an old timepiece — a family heirloom. You’ve no clue how much it costs, but it’s old and works well. Or it’s 24-karat gold. Or, just maybe, it’s a hard-hitting brand like a Cartier or a Rolex.

Same question: Should you get watch insurance?

Let’s explore how to insure a watch.

Table of Contents

Is It Worth Getting Watch Insurance

To figure out whether or not you should even consider watch insurance, there are two big things to look at.

First of all, of course, you must ask yourself if it’s even a valuable item. You may not need to insure your $200 Timex, even if it is super cool.

If it’s an expensive grail or a rare limited edition, then you’ve checked a prerequisite.

What if it’s a family heirloom with more sentimental value rather than monetary value? Then, you need to consider whether or not paying for insurance is worth it.

If it’s lost or stolen, then there’s truly no replacing it. You may think that insurance isn’t worth it after all. Or, perhaps a payout would offer a sense of consolation.

That’s a personal thing and something you should figure out for yourself.

Second, what kind of lifestyle do you lead? Do you travel a lot? Because that heightens the risk of loss and even theft.

Do you live an urban lifestyle in which you’re out and about on the street a lot or commuting via the subway? Similarly, your overall exposure also exposes you to loss and theft.

Remember, watches are one of the most alluring things to thieves. If your house gets burgled, it’s a certainty they’ll go for any freestanding watches.

What Is the Best Way To Insure a Watch?

When it comes to insuring a watch, the first thing to consider is your home or renter’s insurance. Figure out whether or not it covers your watch or watches fully. And if it does, do you actually want it insured under that umbrella?

Here’s what I mean.

Home Insurance

Your home or renter’s insurance may cover personal belongings like jewelry and watches. However, it may have a limit.

The limit might be up to $5,000, and you know for a fact your collection, along with your other personal belongings, will be covered. If this is the case, you’ve already insured your watch the best way you can.

This completely depends on the insurance policy and company, though. Some insurance companies might agree to cover personal items but won’t cover a watch over a certain amount.

Or, it could be that your sublimit for personal items, or whatever category your insurer places your watches, covers all of your watches. But let’s say your watches will take up over half of the sublimit.

Does this make sense for your situation? It might, but I can’t imagine it would for most of us.

Given coverage limits like this, you may have to get individual insurance for your watch or watches.

Sometimes, you can do it right within your home insurer. Many policies offer addendums and add-ons, called a rider, to cover more ground.

Stand-Alone Insurance

You might have a huge, valuable collection. Or, you may have just one really special piece, perhaps an outlier to your otherwise sober and minimalist approach to consumerism.

In either of these cases, you might consider stand-alone insurance for your watch or watches.

Here are some things to look out for when choosing a stand-alone policy for your timepieces — and a lot of this might apply to jewelry, too!

- Does it cover mysterious disappearance?

- Is it valid for overseas or international travel?

- Will the coverage adjust depending on inflation? If your watch is made of precious metal or has diamonds on it, the price of these elements may fluctuate depending on the economy.

- For damage, can you choose your repairer? If not, do you approve of the repairers in their network?

- What’s the deductible?

- How much of the appraised value is covered in any situation? This may differ from if you have a house fire compared to if you lose it while traveling.

- How does the policy pay you out?

- Do you need to get your watch appraised?

Related to that last point, you may want to get your watch appraised anyway. A lot of insurers will require a formal appraisal if your collection or a single timepiece is clearly over a certain price.

Let’s say the company requires an appraisal for watches over $3,000. If you inherited a working Rolex Submariner in good condition, you may not know the exact price. But it definitely meets the threshold for said company’s appraisal requirement.

How Much Does It Cost To Insure a Watch?

Usually, insurance costs up to 2% of the watch’s value. However, this is highly variable. It varies from company to company, and within that, policy to policy, and from state to state.

Of course, the more expensive the watch, the higher the insurance cost. Comprehensive coverage will cost more than partial coverage.

Still, you don’t always need complete coverage. If you live in a place that never floods, why would you need flood insurance? It’s a matter of figuring out what’s right for you.

Importantly, like with health insurance, your circumstances may affect the cost.

If you have top-notch security measures, your premium might be lower. Someone with a sophisticated security system at their house, who keeps their watches in a safe, demonstrates responsibility.

Other factors that will affect insurance prices include regional regulations for insurance (which is why prices differ so much from state to state) and crime rates.

Conclusion: Choosing Insurance Policies

There you go — that’s how to insure a watch.

There’s no specific coverage that’s right for everyone.

You have to choose based on why you want to get insured, what the risks are, and what you’re willing to pay for peace of mind.

Remember that a watch warranty will only cover mechanical failure and occasional wear and tear. It’s the brand or seller’s way of holding themselves accountable.

However, theft, unforeseen damage, and loss can only be covered by insurance.

Do you insure your watches? Are you considering doing it? Let us know your thoughts!

Leave a Reply